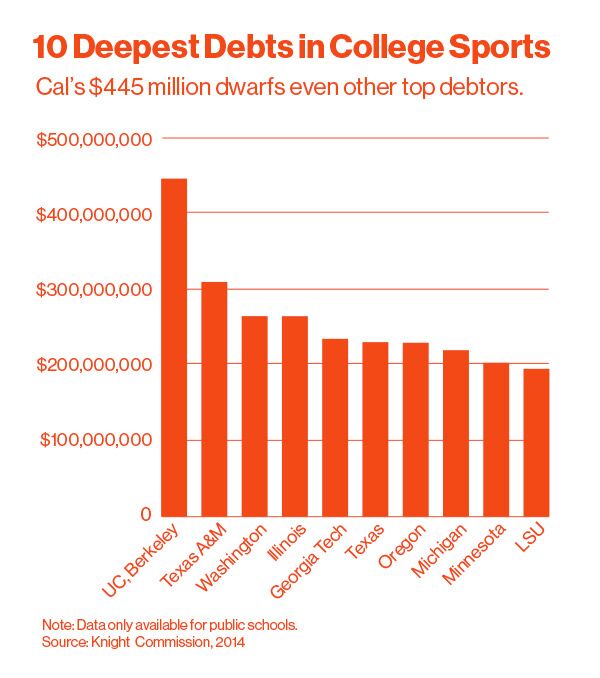

It's worth noting that GTAA's balance sheet also has $110 million in financial assets. I don't mean fixed assets net of depreciation, but financial assets held by the Georgia Tech foundation.

So the net financial debt is $115 million. The balance sheet also has $9 million in long-term pledges to the foundation as a noncurrent asset, which includes allowance for uncollectible pledges receivable. That brings down the financial debt to $106 million.

The book value of the GTAA is $77 million, but book value is kind of worthless for valuation. Book value is how much is paid for your capital minus depreciation. The depreciation schedule is guesswork. Are the north stands going to be good for 25 years or 50 years?

I would compare the $106 million in net debt to how much the GTAA would be worth if you could buy the athletic assets free and clear (not including the investments). Operating income was $2.8 million in 2015, only $150k in 2014 and -1.7 million in 2013 (peak of paying coaches not to work). I'm including depreciation because as the free and clear owner of the GTAA, you would have to replace depreciated assets. All of the operating income includes a $900k payment to Hewitt through 2019:

Contract agreement-current portion consists of short term contractual payments due to the former Head Men’s Basketball Coach whose employment with the Association ended in April of 2011. As required by contract, the Association will make payments totaling $906,250 each fiscal year through the end of FY 19.

The increase in operating income from 2014 in 2015 was mainly due to $8mil more from ACC revenue distributions. Without Hewitt, the operating income would have been $3.8 million. Being charitable, I'll use that number dividend of perpetuity. I'll also only use 5% discount rate. (3.8)/(5%) = $76 million.

So that means the GTAA with $106 million of net debt has a worth of -$30 million. Over the long-run, it will be made up with two different things:

1. Financial arbitrage. The bonds are long-dated and, I think, are tax-deductible municipals. The investments are part of the ~$1.8 billion GT Foundation endowment. There theoretically should be long-term returns from this leveraged, low-cost portfolio.

2. Possible higher future endowment contributions. The operating income includes endowment contributions.

Ultimately, there is a backstop by GT itself and GT will subsidize the GTAA like how most AA's are subsidized. GT had $1.2 billion in operating revenue a year and a $1.8 billion endowment. So the $30million negative net worth could certainly be absorbed in the end.