- Joined

- Mar 28, 2011

- Messages

- 37,957

Introducing Stingtalk Butthurt Exchange v.2017. In this game each player is given $10,000 and you have the option of buying 3 commodities and futures on those commodities. The commodities are ButthurtCoin (BHC), HypeCoin (HypC or kool-aid) and MutthurtCoin (MHC). The trading is not P2P but between the Exchange and the player.

ButthurtCoin

BHC is your traditional stingtalk commodity that puts a monetary value on the level of butthurt of the Tech fanbase as a projection of Stingtalk butthurt. BHC prices are affected by each win or loss, streak wins or losses, number of wins and losses, making it to top 25, top 10 or top 5 or dropping in rankings, making or not making it to the postseason, winning or losing in the postseason all the way up to the final and also the outcome of uga's season in the same outline. Each scenario is assigned a coefficient and the price changes from the previous week is calculated by multiplying it by those coefficients and also volume ratio adjustment within 5% (The traded volume ratio between BHC and HypC). So if the team keeps winning, BHC prices will keep declining, and losses will increase the prices but also affected by how UGA did that same week. BHC prices will be posted every Monday following the last Tech or UGA game played (Tuesday if the game is on a Monday) and trading will be allowed on that price until close of business (5pm EST) the day prior to the first game of next week. Future prices will also be posted on the same day to be executed for the monday following the last game.

HypeCoin

HypC prices will move in the opposite direction of BHC prices. The only other difference is that HypC will not be affected by the outcome of UGA games.

MutthurtCoin

MHC dynamics is very much the same as BHC (with different coefficients) and also affected by BHC.

Future Trading

TL;DR version:

Buy HypC if you think we're gonna win, sell and buy BHC if you think we're gonna lose. The percentage changes will be significant for each win or loss (since we're all emotional bitches) so don't buy and hold for the whole season.

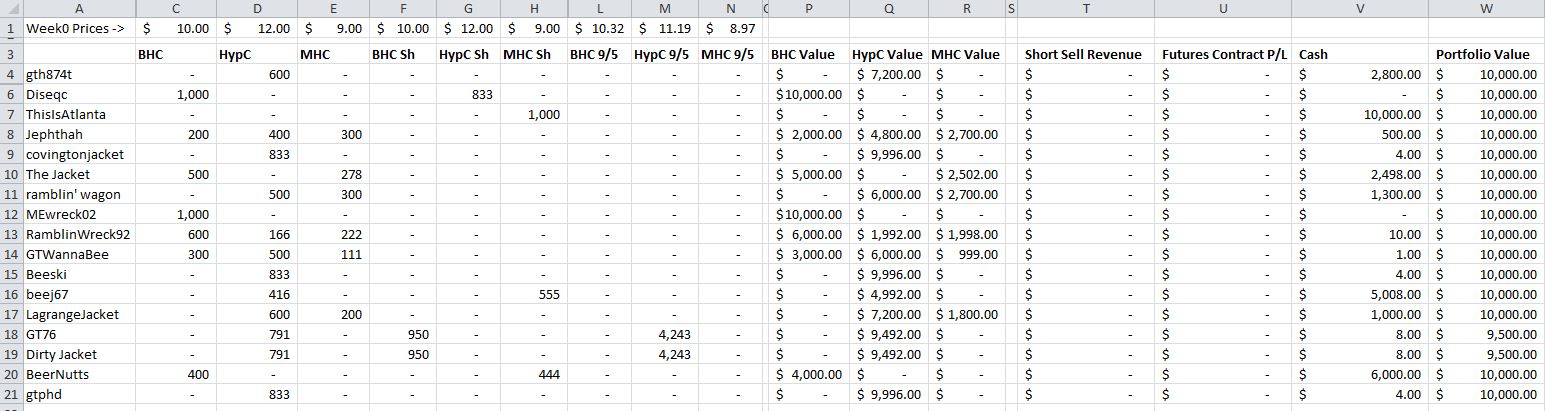

With that being said here are the prices for Week 0. Prices are good to trade until September 1st, 2017 5.00pm. The outcomes of Tennessee @ GT and App State @ UGA games will affect the prices on 9/5.

The player rankings will be posted on the same day as prices.

Price Chart- Week 0

BHC

$10.00

HypC

$12.00

MHC

$9.00

BHC 9/5

$10.32

HypC 9/5

$11.19

MHC 9/5

$8.97

Post your trades here. Good luck!

ButthurtCoin

BHC is your traditional stingtalk commodity that puts a monetary value on the level of butthurt of the Tech fanbase as a projection of Stingtalk butthurt. BHC prices are affected by each win or loss, streak wins or losses, number of wins and losses, making it to top 25, top 10 or top 5 or dropping in rankings, making or not making it to the postseason, winning or losing in the postseason all the way up to the final and also the outcome of uga's season in the same outline. Each scenario is assigned a coefficient and the price changes from the previous week is calculated by multiplying it by those coefficients and also volume ratio adjustment within 5% (The traded volume ratio between BHC and HypC). So if the team keeps winning, BHC prices will keep declining, and losses will increase the prices but also affected by how UGA did that same week. BHC prices will be posted every Monday following the last Tech or UGA game played (Tuesday if the game is on a Monday) and trading will be allowed on that price until close of business (5pm EST) the day prior to the first game of next week. Future prices will also be posted on the same day to be executed for the monday following the last game.

HypeCoin

HypC prices will move in the opposite direction of BHC prices. The only other difference is that HypC will not be affected by the outcome of UGA games.

MutthurtCoin

MHC dynamics is very much the same as BHC (with different coefficients) and also affected by BHC.

Future Trading

Futures Trading

Introducing Futures trading. Futures contract is a large bet on where you think the market will move. It is not taking ownership of the underlying commodity. The advantage of making futures contract is that the gains are significant since you make a bet for 5 times the amount of the underlying commodity you could have outright bought. The disadvantage of a futures contract is you will lose significant amount of money (perhaps be out of the game) because the bet is so large (minimum bet of $47,500). The futures prices will be updated once a trading week and purchasing a futures contract costs $500. Future prices are calculated based on vegas odds so they're influenced by whether we are an underdog or a favorite.

So here's an example:

HypC Spot price: $12.00

9/5 HypC Futures Price: $11.19

The most HypC you can buy at this price is 833 HypC. If you were to enter into a futures contract instead you're making a $47,500 bet on 9/5 HypCs. $10,000 starting cash - $500 future contract cost = $9,500 cash. $9,500 x 5 = $47,500. Now here are the scenarios:

Scenario 1 HypC skyrockets:

If HypC price were to go up to $14.06 on 9/5 and you're simply an owner of 833 HypC, here's what your portfolio would look like:

Cash: $4

833 HypC Value: $11,712 (bought at $9,996)

Total Portfolio Worth: $11,716.74

% Change from Prior Week: %17.2 increase

If you were instead entered into a futures contract instead here's how it would look like:

Starting Cash: $9,500

HypC Futures contract profit (added to cash): $12,162

($47,498 HypC futures now worth $59,660)

+

---------------------------------------------------------------------------

Total Cash: $21,662

Total Portfolio Worth: $21,662

% Change from Prior Week: %216.6 increase

So as you can see HypC futures yielded a much much larger return. Let's take a look at the other scenario where HypC plummets.

Scenario 2 HypC plummets:

If HypC price were to go down to $9.25 on 9/5 and you're an owner of 833 HypC, here's what your portfolio would look like:

Cash: $4

833 HypC Value: $7,708.45 (bought at $9,996)

Total Portfolio Worth: $7712.45

% Increase from Prior Week: %23 decrease

If you were instead entered into a futures contract instead here's how it would look like:

Starting Cash: $9,500

HypC Futures contract loss (subtracted from cash): $8,234.58

($47,498 HypC futures now worth $39,264)

-

----------------------------------------------------------------------------------------

Total Cash: $1,265.42

Total Portfolio Worth: $1,265.42

% Change from Prior Week: %87.7 decrease

Having said all that, you can also short futures contracts. All the same rules apply. Rather than making a bet on the price going up you'd be making a bet on price going down. Futures are cash settled on the settlement date (no positions to stay open).

Minimum and Maximum Contracts

The minimum bet is the same for all weeks and that is $47,500. This is calculated by subtracting $500 from your starting cash of $10,000 and multiplying by 5. The maximum bet is also calculated by subtracting $500 cash from your portfolio value and multiplying by 5. So if your portfolio is worth more than $10,000 (cash and other assets included) then your maximum bet is your total portfolio minus $500 cash times 5. All you need to play right now is $500 cash. If you were to lose on the futures contract, to settle it first your cash will be subtracted from balance, then your assets from largest to smallest.

You can't enter a futures contract if you have less than $10,000 in portfolio value and because the minimum will not change from $47,500.

What do we do now?

If you have recently made a short sell and you still have $10,000 cash you can enter a futures contract as well.

If you bought BHC, MHC or HypC earlier and you'd like to buy some futures now as long as you got $500 cash you can buy it. If you have less than $500 cash tell me which commodities you own to sell back to the exchange to make $500 (if your portfolio's diversified.)

Introducing Futures trading. Futures contract is a large bet on where you think the market will move. It is not taking ownership of the underlying commodity. The advantage of making futures contract is that the gains are significant since you make a bet for 5 times the amount of the underlying commodity you could have outright bought. The disadvantage of a futures contract is you will lose significant amount of money (perhaps be out of the game) because the bet is so large (minimum bet of $47,500). The futures prices will be updated once a trading week and purchasing a futures contract costs $500. Future prices are calculated based on vegas odds so they're influenced by whether we are an underdog or a favorite.

So here's an example:

HypC Spot price: $12.00

9/5 HypC Futures Price: $11.19

The most HypC you can buy at this price is 833 HypC. If you were to enter into a futures contract instead you're making a $47,500 bet on 9/5 HypCs. $10,000 starting cash - $500 future contract cost = $9,500 cash. $9,500 x 5 = $47,500. Now here are the scenarios:

Scenario 1 HypC skyrockets:

If HypC price were to go up to $14.06 on 9/5 and you're simply an owner of 833 HypC, here's what your portfolio would look like:

Cash: $4

833 HypC Value: $11,712 (bought at $9,996)

Total Portfolio Worth: $11,716.74

% Change from Prior Week: %17.2 increase

If you were instead entered into a futures contract instead here's how it would look like:

Starting Cash: $9,500

HypC Futures contract profit (added to cash): $12,162

($47,498 HypC futures now worth $59,660)

+

---------------------------------------------------------------------------

Total Cash: $21,662

Total Portfolio Worth: $21,662

% Change from Prior Week: %216.6 increase

So as you can see HypC futures yielded a much much larger return. Let's take a look at the other scenario where HypC plummets.

Scenario 2 HypC plummets:

If HypC price were to go down to $9.25 on 9/5 and you're an owner of 833 HypC, here's what your portfolio would look like:

Cash: $4

833 HypC Value: $7,708.45 (bought at $9,996)

Total Portfolio Worth: $7712.45

% Increase from Prior Week: %23 decrease

If you were instead entered into a futures contract instead here's how it would look like:

Starting Cash: $9,500

HypC Futures contract loss (subtracted from cash): $8,234.58

($47,498 HypC futures now worth $39,264)

-

----------------------------------------------------------------------------------------

Total Cash: $1,265.42

Total Portfolio Worth: $1,265.42

% Change from Prior Week: %87.7 decrease

Having said all that, you can also short futures contracts. All the same rules apply. Rather than making a bet on the price going up you'd be making a bet on price going down. Futures are cash settled on the settlement date (no positions to stay open).

Minimum and Maximum Contracts

The minimum bet is the same for all weeks and that is $47,500. This is calculated by subtracting $500 from your starting cash of $10,000 and multiplying by 5. The maximum bet is also calculated by subtracting $500 cash from your portfolio value and multiplying by 5. So if your portfolio is worth more than $10,000 (cash and other assets included) then your maximum bet is your total portfolio minus $500 cash times 5. All you need to play right now is $500 cash. If you were to lose on the futures contract, to settle it first your cash will be subtracted from balance, then your assets from largest to smallest.

You can't enter a futures contract if you have less than $10,000 in portfolio value and because the minimum will not change from $47,500.

What do we do now?

If you have recently made a short sell and you still have $10,000 cash you can enter a futures contract as well.

If you bought BHC, MHC or HypC earlier and you'd like to buy some futures now as long as you got $500 cash you can buy it. If you have less than $500 cash tell me which commodities you own to sell back to the exchange to make $500 (if your portfolio's diversified.)

TL;DR version:

Buy HypC if you think we're gonna win, sell and buy BHC if you think we're gonna lose. The percentage changes will be significant for each win or loss (since we're all emotional bitches) so don't buy and hold for the whole season.

With that being said here are the prices for Week 0. Prices are good to trade until September 1st, 2017 5.00pm. The outcomes of Tennessee @ GT and App State @ UGA games will affect the prices on 9/5.

The player rankings will be posted on the same day as prices.

Price Chart- Week 0

BHC

$10.00

HypC

$12.00

MHC

$9.00

BHC 9/5

$10.32

HypC 9/5

$11.19

MHC 9/5

$8.97

Post your trades here. Good luck!

Last edited: